Kalaka is your personal wealth maximizer mobile app designed to protect your money from inflation, banking, and government crises while transforming your salary into wealth.

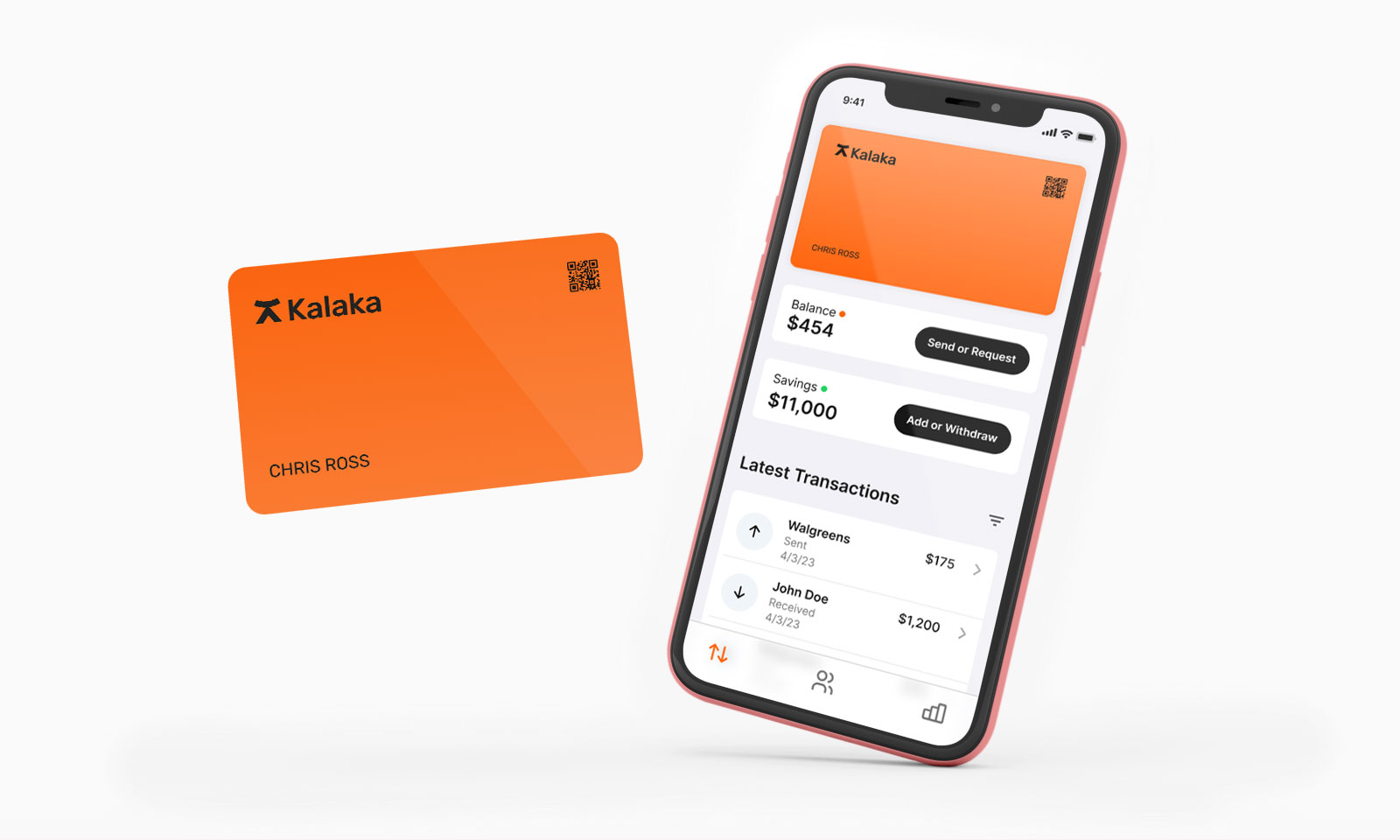

Credit Card by Kalaka

A free, private, and secure credit card that is accepted worldwide, with low purchase fees, no fees on in-network purchases, and its APR is going directly to your savings account.

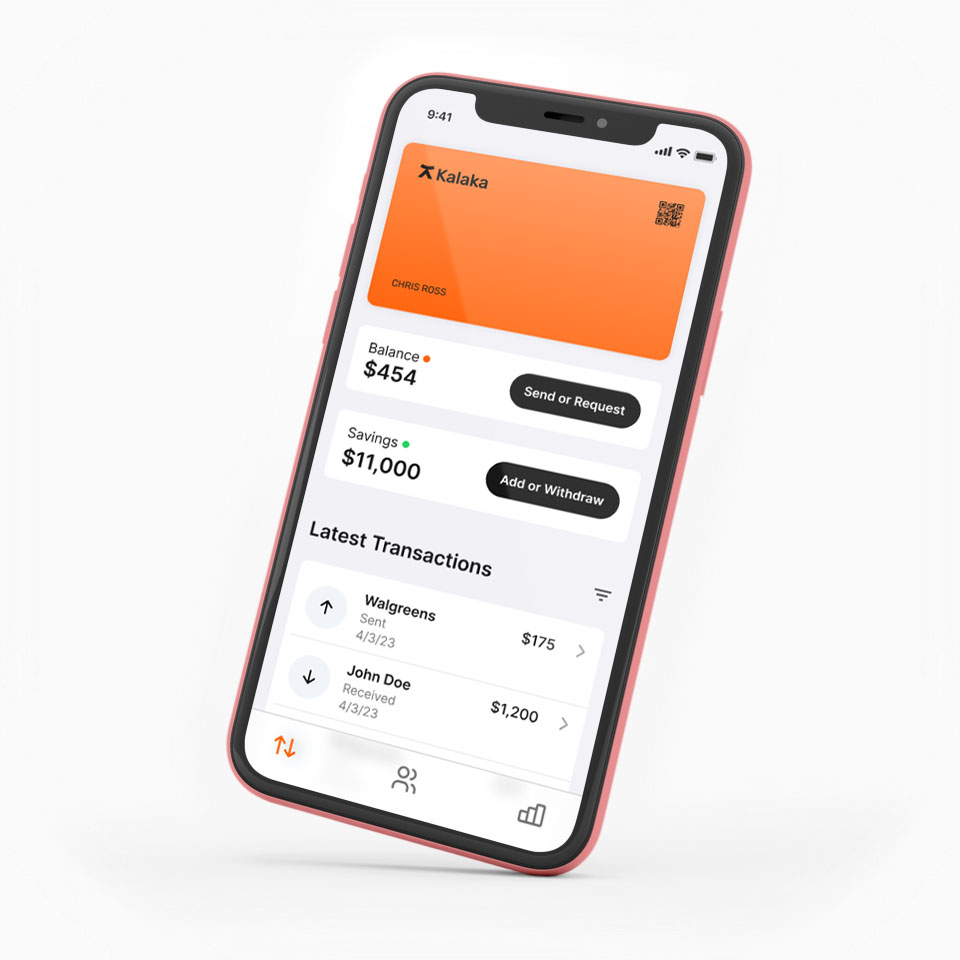

Savings Account by Kalaka

A secure and high-yielding savings account that will effortlessly put you in control of your financial life while transforming your salary into millions.

When finance is done right you don’t need to rely on banks & governments to keep your money safe.

Inflation Proof

Kalaka’s savings account is resistant to the effects of inflation

Community Owned

All account holder automatically becomes a micro co-owner of Kalaka

Bank Run Proof

At Kalaka bank runs are impossible by design as we only work with collateralized lending

High-yield

High-yield savings account with 3 simple risk levels that you can choose from

Private & Secure

Your money cannot be taken away by anyone – banks, governments, or even Kalaka itself

Borderless & Fast

Send and receive money to and from anyone in the world instantaneously

Mission

Helping people to effectively grow & exchange value

Common Questions

What does "kalaka" means?

“Kalaka” is a Hungarian word for an ancient, trust-based economic concept of reciprocity. Similar concepts developed independently all around the world under different names: the Andean mountain communities of South America call it “Ayni”, The Zulu communities of South Africa call it “Ubuntu”, Filipinos call it “Bayanihan”, Cherokee Indians of North America it “Gadugi”, and Indonesians and Malaysians called it Gotong-royong. The names are different, the concept is the same: trust-based communities built on reciprocity “Today it’s me, tomorrow it’s you” – this is the spirit of Kalaka.

What is a banking crisis?

A banking crisis is a situation where many banks or financial institutions are experiencing financial distress, often due to a combination of factors such as bad loans, risky investments, or a lack of liquidity. This can lead to bank failures, bailouts, and a disruption in the availability of credit, which can have a negative impact on the overall economy.

What is a government crisis?

A government crisis is a situation where a country’s leadership faces significant challenges or instability, often involving political disagreements, scandals, or economic problems. A government crisis can impact people’s bank accounts and savings through fluctuating interest rates, currency devaluation, or changes in economic policy, making it harder to keep or grow wealth.

What is a bank run?

A bank run is when many people, worried their bank might run out of money, all withdraw their cash at once. This can cause big problems for the bank because they don’t have all that cash on hand, and it might even make the bank fail. This happens more often than you might think, and it could have already affected you or someone you know. The most significant bank run examples in US history are the Great Depression (1930-1933), Continental Illinois National Bank (1984), and the recent SWB Bank (2023) collapse. These unfortunate events are the direct result of a legally allowed practice in our current banking system called fractional reserve lending, which lets banks lend more money to borrowers than they actually own. This is why the US banking system is in a fragile state like never before, with only less than 3% of the money available in banks in case of a bank run. Learn more

How can a bank run out of money?

A bank can run out of money during a bank run when many customers, fearing the bank’s bankruptcy, withdraw their cash simultaneously. Banks use fractional reserve lending, lending most of their deposits, which means they don’t have enough cash on hand to meet all withdrawal demands.

What is fractional-reserve banking?

Fractional-reserve banking is when banks keep only a small portion of deposits as cash and lend out the rest. This allows banks to make loans and earn interest but means they don’t have enough cash on hand to cover all deposits if many customers withdraw their money at once – also known as a “bank run”. Learn more

What is fully-reserved banking?

A fully reserved banking system is a type of banking where financial institutions are required to hold 100% of their depositors’ funds in reserve, either as cash or in other highly liquid assets. This means banks cannot use customer deposits for lending or investing. This system aims to prevent bank runs and provide greater financial stability, but it may limit the availability of credit and reduce banks’ profitability.

Does Kalaka use fractional-reserve banking?

No, and it will never will. At Kalaka, we believe in using a fully reserved financial model. More details on this coming soon.

Is Kalaka bank run proof?

More details on this coming soon.

What is a recession?

A recession is a period when the economy slows down, with less money being made and spent. It can affect people’s savings through low-interest rates, while job loss or reduced income may force them to use their savings to cover living expenses. Learn more

Is Kalaka recession proof?

More details on this coming soon.

What is inflation?

Inflation is the rate at which prices for goods and services increase over time, making money worth less. Inflation can affect people’s bank accounts by eroding the purchasing power of their savings. If the interest earned on savings doesn’t keep up with inflation, the real value of the savings decreases, making it harder to maintain or grow wealth. Learn more

Is Kalaka inflation resistant?

More details on this coming soon.

What is a digital bank?

A digital bank, like Kalaka, is a financial institution that operates exclusively online without any physical branches. Customers access their accounts and perform banking activities through mobile apps or websites. Digital banks typically offer services like checking accounts, savings accounts, loans, and credit cards, often with lower fees and innovative features compared to traditional banks. Learn more

What is KAL?

More details on this coming soon.

Where does Kalaka keep my money?

More details on this coming soon.

What are US Treasury Bonds?

More details on this coming soon.

What are the difference between Treasury Bonds & Blue Chip Crypto Currencies?

More details on this coming soon.

What are the key differences between BTC and KAL?

More details on this coming soon.

Why KAL should become the next reserve currency of the world?

More details on this coming soon.

Why did FTX, Terra, Celsius, etc. collapse, and why Kalaka will not?

More details on this coming soon.

Who owns Kalaka?

More details on this coming soon.

How can Kalaka be governed by its community and why is this important?

More details on this coming soon.

What is the difference between privacy and anonymity?

More details on this coming soon.

Is Kalaka private?

More details on this coming soon.

Is Kalaka anonym?

More details on this coming soon.

Is Kalaka fast?

More details on this coming soon.

Is Kalaka safe?

More details on this coming soon.

Is Kalaka secure?

More details on this coming soon.

Is Kalaka a US-based bank?

More details on this coming soon.

Is Kalaka an international bank?

More details on this coming soon.

Is Kalaka has a valid US banking license?

More details on this coming soon.

Is Kalaka FDIC insured?

More details on this coming soon.

Is Kalaka compliant with FDIC?

More details on this coming soon.

Is Kalaka compliant with the Federal Reserve Bank?

More details on this coming soon.

How does the Kalaka Credit Card work?

More details on this coming soon.

How does the Kalaka Digital Account work?

More details on this coming soon.